What ‘We Didn’t Start The Fire’ can teach you about markets and global events

Around the time of his 40th birthday, American music legend Billy Joel was in the studio recording what would be his 1989 album, Storm Front.

A young Sean Lennon stopped by the studio with another friend his age and bemoaned what a turbulent time they were growing up in. Joel countered by suggesting that he’d also come of age during another exhausting moment in history.

But, in Joel’s telling, Lennon’s friend countered: “You were a kid in the ’50s. And everybody knows that nothing happened in the ’50s.”

As soon as these youngsters left, Joel began writing down bite-sized headlines from his youth, if only to prove his point.

“The chain of news events and personalities came easily — mostly they just spilled out of my memory as fast as I could scribble them down,” Joel told his biographer Fred Schruers.

That song became the Billboard number one smash ‘We Didn’t Start The Fire’, which celebrates its 35th birthday this year.

In the song, Joel essentially tells the story of the period of the Cold War, covering 119 events from his birth – Harry Truman, Doris Day, Red China, Johnnie Ray – to 1989 when he wrote the song.

Interestingly, the events chronicled in the much-loved hit can teach you much about long-term investing, remaining patient, and not letting news headlines or uncertainty get in the way of your objectives. Read on to find out why.

Periods of uncertainty over time are almost guaranteed

Uncertainty has been a feature of the human race for centuries. Wars, conflict, extreme weather, and political upheaval have all shaped humanity and, as Joel says, as much in the 1950s as in the 1980s and beyond.

As Joel sings: “We didn’t start the fire – it was always burning since the world’s been turning”.

Of course, markets can react negatively to uncertainty. It can cause falls in stock market values, as investors buy and sell investments following world events such as those chronicled in the song.

However, the lesson to learn is that periods of uncertainty over time are almost guaranteed, and you are going to see the value of your investments rise and fall over time. The key is learning to stay calm when these events occur.

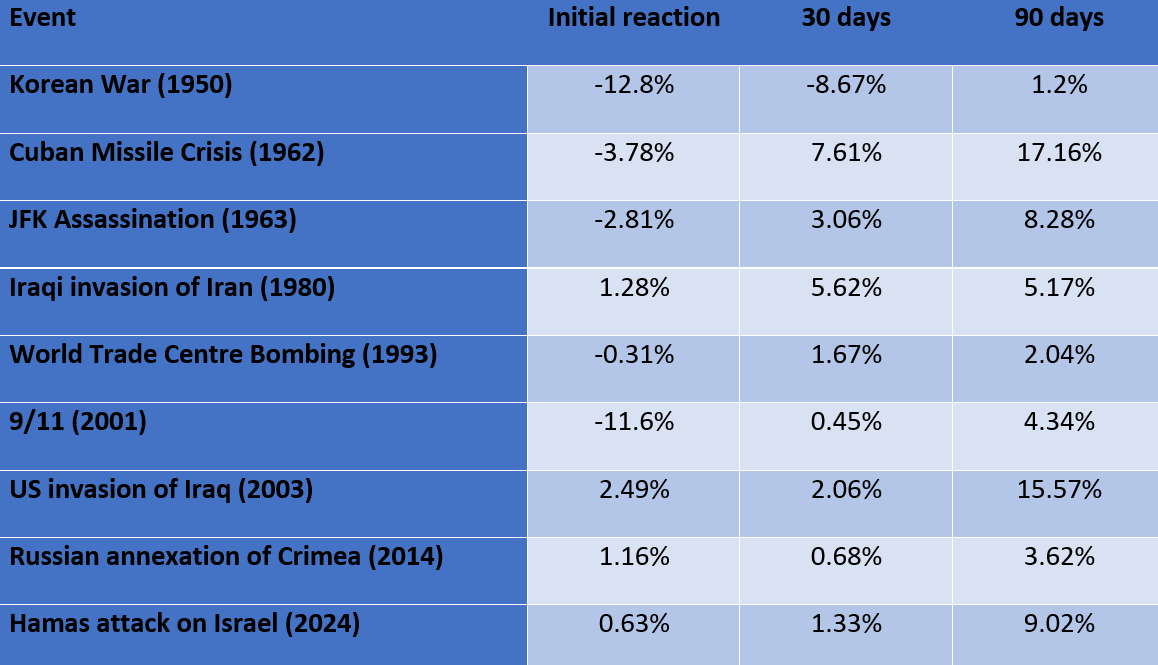

Professional Wealth Management looked at some of the significant events of the last 75 or so years – many of which Joel sings about in ‘We Didn’t Start The Fire’ – and their impact on the value of the S&P 500, a leading index of 500 of America’s biggest companies.

Source: Professional Wealth Management

Essentially, following each of these events, the value of the stock market had risen by the 90th subsequent day – even if it had fallen in the short term. So, had you remained patient and invested during these uncertain periods, you’d likely have seen growth in your portfolio.

Switching to cash after a stock market fall can damage your long-term growth

Cashing in your investments when markets take a tumble – whether that’s trouble in the Suez or Belgians in the Congo – can be detrimental to your wealth over the long run.

Here are some examples.

Schroders report that, if you had shifted to cash in 1929, after the first 25% fall of the Great Depression, you would have had to wait until 1963 to return to break even. Had you stayed invested in the stock market, you’d have broken even in early 1945 – 18 years sooner.

The chart below shows how long it would have taken you to recoup losses had you stayed invested versus switching to cash after a 25% market decline at various periods during Billy Joel’s distinguished career.

Source: Schroders

The message is overwhelmingly clear: exiting the stock market in favour of cash in response to a big market fall would have been very bad for your wealth over the long run. Indeed, had you done so in 2008, you’d still not have broken even, whereas staying invested would have seen you break even in 2013.

Get in touch

We take an evidenced-based investment approach (mainly Dimensional) and believe in the long-term performance of markets with balanced portfolios back-tested over decades (using Timeline historical data going back to 1915 – way before even Billy Joel was around!)

If you’d like to chat about current market uncertainty or review your portfolio, please get in touch at info@macfp.co.uk or call 01349 832849.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.