Why staying calm and focusing on your pension plan is the best response to recent Budget announcements

If you read your Autumn Budget update back in October, you’ll already know about some of the pension changes announced by Rachel Reeves.

You’ll no doubt also be aware that Scotland’s Finance Secretary, Shona Robison, delivered her Scottish Budget on 4 December.

Keep reading to find out what the changes in Westminster might mean for your retirement saving plans and all the main headlines from Robison’s statement.

There were some high-profile announcements but no changes to your long-term plans

Speculation was rife in the run-up to the Budget with pensions expected to be firmly in the chancellor’s sights.

In reality, though, very little changed immediately, with other announced changes subject to consultations and future deadlines.

An end to the Income Tax threshold freeze… but not until 2028

Both the Personal Allowance and Income Tax thresholds were frozen under consecutive Conservative chancellors, to 2026 and then 2028, respectively.

While Reeves did extend some freezes, she confirmed that personal tax thresholds will once again be uprated annually and in line with inflation from 2028/29.

This will mean you can earn more – or receive more pension income – before paying Income Tax, but not for another two years. As your wage or index-linked income increases in the meantime, you might still see a rise in your tax bill.

Remember that your pension remains the best way to save for retirement. It is highly tax-efficient for money going in and continues to have tax benefits (including an entitlement to 25% tax-free cash for defined contribution schemes) on the way out.

If you need budgeting or long-term planning advice, be sure to get in touch.

Inheritance Tax pension changes are no cause for panic so stay calm

One of the higher-profile announcements from the Autumn Budget was the decision to bring pensions into the Inheritance Tax (IHT) net.

Under current rules, unused pension funds can usually be passed to a chosen beneficiary tax-free on death before age 75. Even when death occurs after 75, unused pension funds can still be passed on, but your chosen beneficiary will pay Income Tax on the withdrawals they make, at the highest rate they pay.

The changes, which will bring pension funds into your estate for IHT calculation purposes are still to be consulted on. They aren’t due to come into force until 2026.

The headline here is not to panic. Your pension is designed to provide you with an income after you finish work and to pay for the rest of your life. Your estate planning doesn’t currently begin or end with your pension, and this will remain the case after 2026.

For most couples, the nil-rate and residence nil-rate bands mean that there is no IHT to pay on assets below £1 million.

If you fear that your estate might breach this threshold, be assured that we will be waiting for clarity once the proposals are brought into effect and will give appropriate advice then. In the meantime, we will continue working in line with your long-term plans and goals so that you have “enough” for your future, and if there is anything left over, it will get to the right hands at the right time.

Headlines from the Scottish Budget

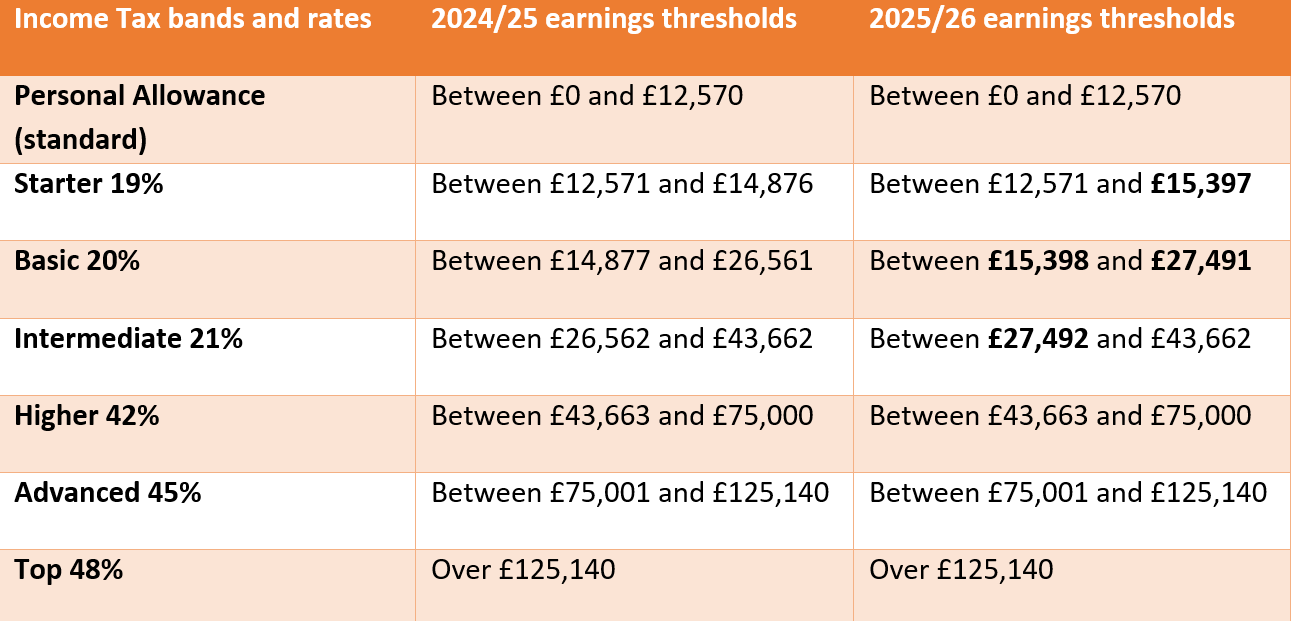

On 4 December 2024, Scotland’s Finance Secretary, Shona Robison, announced the Scottish Budget, which includes changes to the Income Tax rates and bands for the non‑savings non‑dividend income of Scottish taxpayers.

Scottish Income Tax rates and thresholds

Note: The personal allowance is reduced by £1 for every £2 earned over £100,000.

These changes represent the only amendments (for the rest of this parliament) to rates and bands of Scottish Income Tax.

The Scottish government re-committed to ensuring that over half of Scottish taxpayers will pay less Income Tax than in the rest of the UK, promising also to update the starter and basic rate bands, at least by inflation.

Other Scottish Budget announcements included several related to Land and Buildings Transaction Tax (LBTT).

The Scottish government will:

- Keep residential and non-residential rates and bands at current levels, including maintaining first-time buyer relief

- Increase the additional dwelling supplement (ADS) from 6% to 8% for land transactions effective from 5 December 2024 onwards

- Conduct a review of LBTT from spring 2025.

The Scottish government will also:

- Increase Scottish landfill tax (standard and lower rates) to be in line with the UK

- Continue to work on introducing a Scotland-specific air departure tax (ADT) though no date has been given and options are still under consideration

- Introduce a Scottish aggregates tax from 1 April 2026.

We will of course continue to monitor changes to both UK and Scottish legislation to ensure that our advice aligns with the most recent changes to rules and thresholds.

Get in touch

If you’d like to chat about recent Budget changes or any aspect of your long-term financial plans, please get in touch at info@macfp.co.uk or call 01349 832849.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.